How Can Strangled Shanghai Production Activity Further Cool US Truckload Spot Rates?

Long ship queues were a buffer for the US ports to stall ripples of the Chinese slowdown from hitting their shores. With queues being shorter now, it's time the truckload market braces for impact.

A hearty welcome to the 48th edition of The Logistics Rundown, a weekly digest that aims to put some perspective on what’s brewing within the logistics industry. This is a space where we religiously dissect market trends, chat with industry thought leaders, highlight supply chain innovation, celebrate startups, and share news nuggets.

The trucking market continues to be in the spotlight of some heavy debate, as different indicators and industry perspectives point to anything from a seasonal occurrence of a cooling market to an impending trucking recession. While conflicting, all these arguments hold water considering the nature of stakeholders that make up the trucking market.

If you are an owner-operator or small fleet that bought equipment at inflated rates and came into the market last year looking to profit from historically high freight rates, today's rapidly cascading spot market could sound disastrous. But if you are a large carrier running most of your capacity on contracts and buying fuel in bulk and at a discount, there might be little cause for concern.

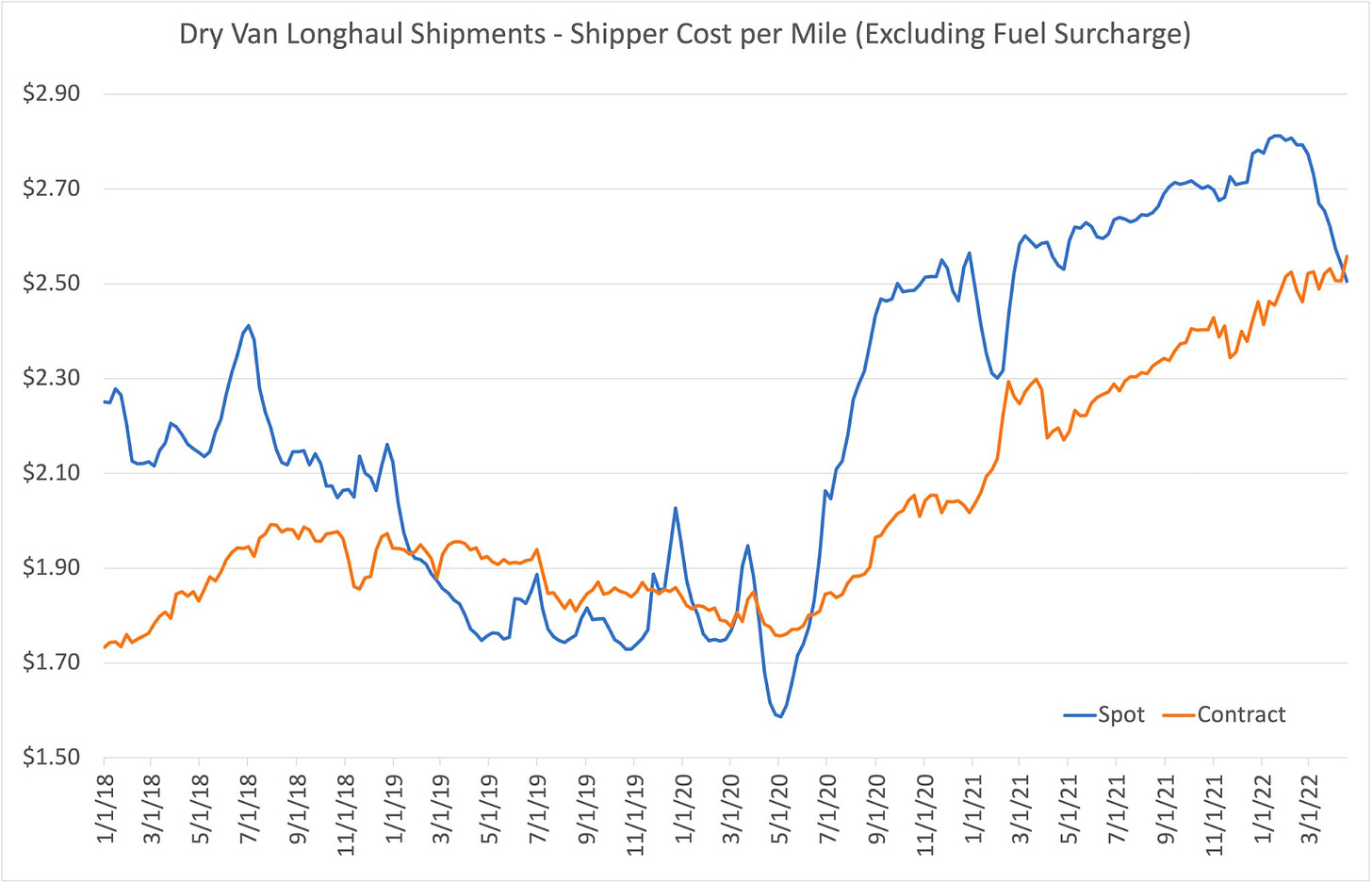

While this trucking downturn has brought back parallels of the '19 trucking collapse, this year's loosening is more due to a capacity glut, rather than a steep fall in consumer demand like we saw in '19. All said and done, most of the freight in the trucking industry moves on contracts. The fact that only the dry van spot market is under stress and flatbed — the indicator of industrial activity — continues to tighten, the overall health of the trucking industry is by all means okay.

While this trucking downturn has brought back parallels of the '19 trucking collapse, this year's loosening is more due to a capacity glut, rather than a steep fall in consumer demand like we saw in '19.

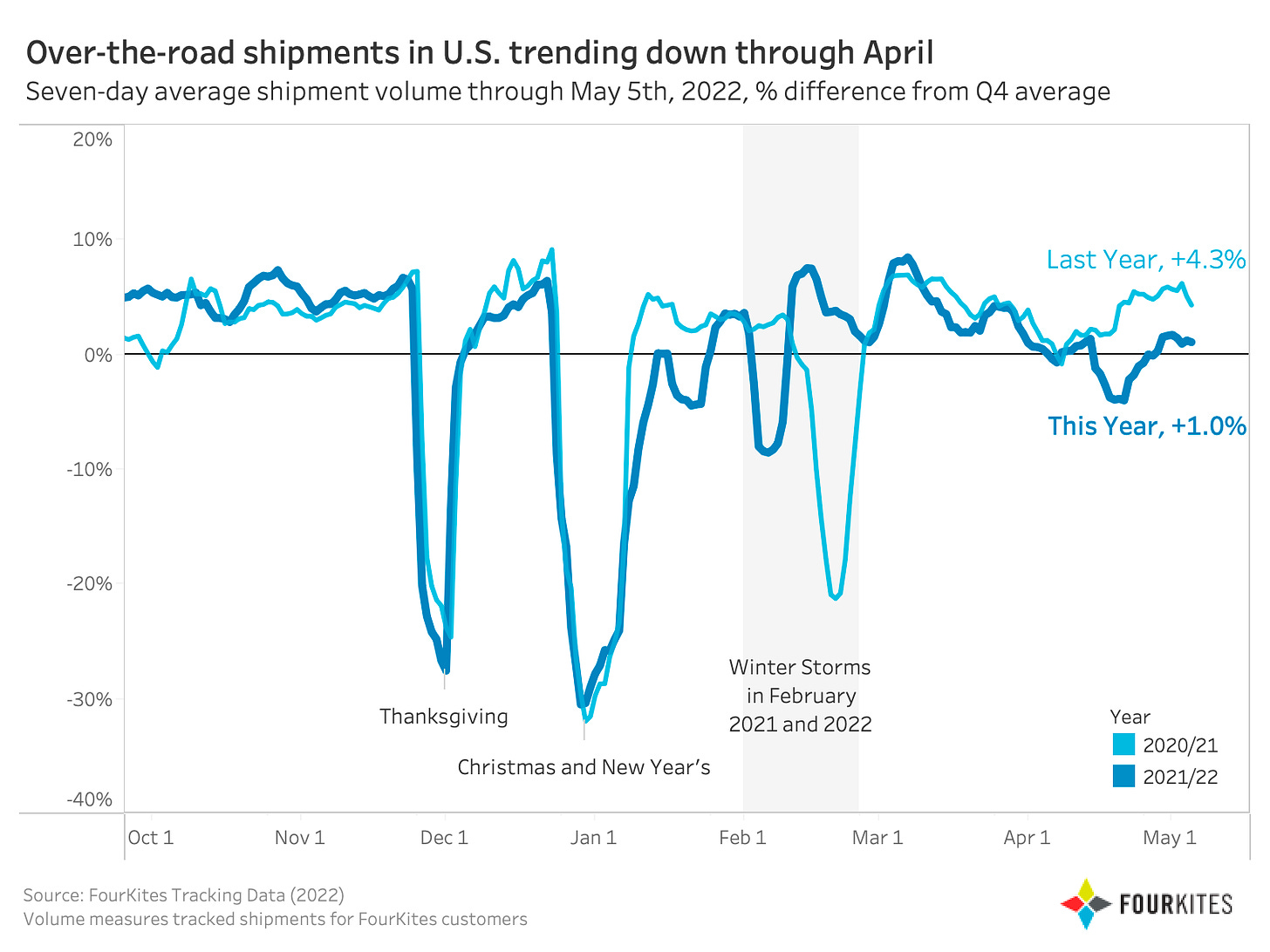

"I think there's a conflation of factors causing the spot market to cool," said Ryan Closser, director of program management and network collaboration at FourKites. "There's definitely a delta between where we were last year and this year. If you layer in the inflationary concerns, the slightly cooling consumer demand, the Shanghai closures and the gap with getting those cargo ships to the US, it makes sense we are seeing a fall in volumes hauled."

The Shanghai debacle is an essential piece of this puzzle. In many ways, continuing restrictions brought on Shanghai could lead to a chain of events that can further loosen the trucking spot market in the US.

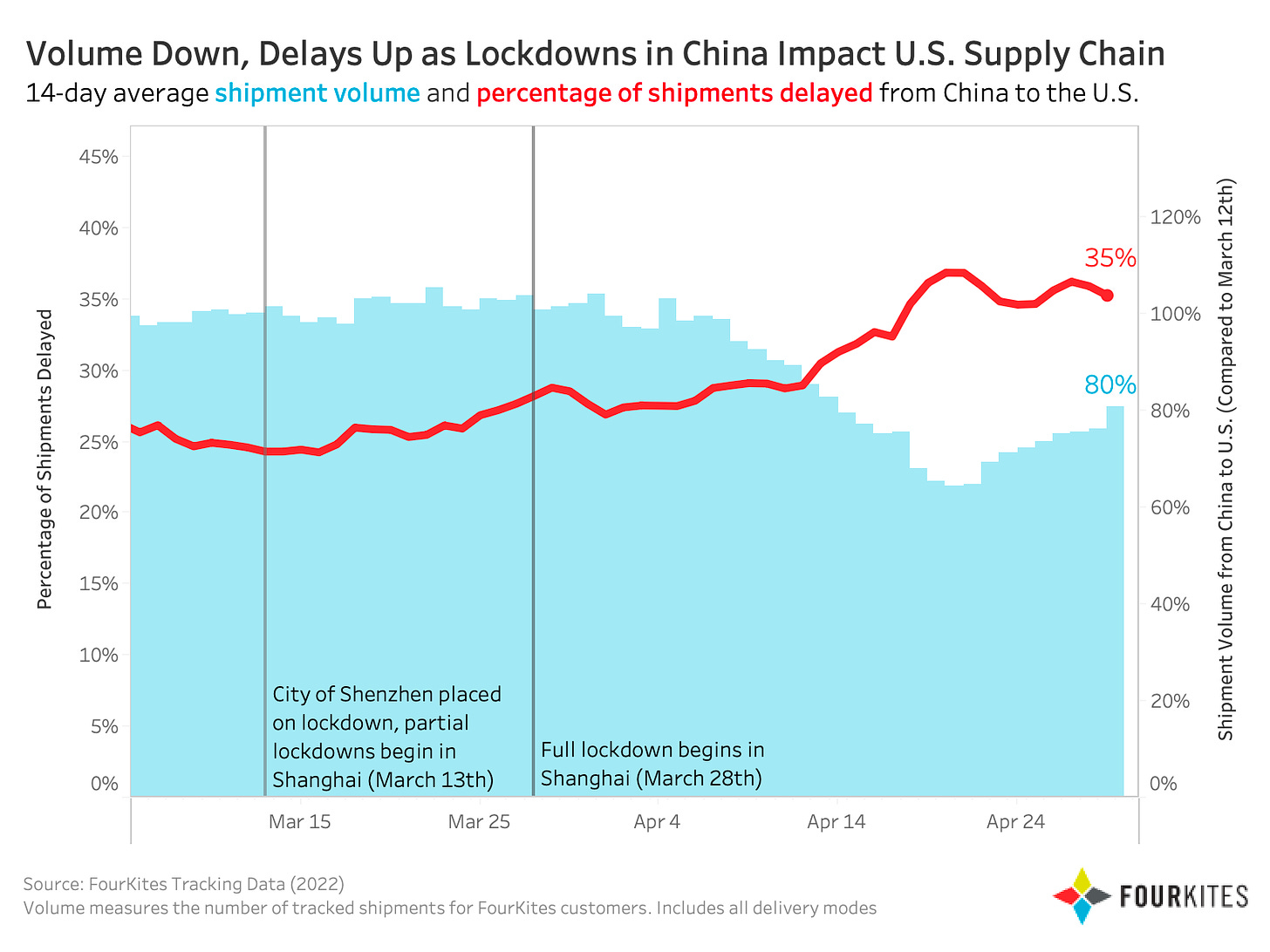

It helps to follow the trail. A scaling down of industrial activity over March and April in China led to reduced exports. FourKites' 14-day average shipment volume for loads traveling from China to the US was down 20% as of April 29 compared to March 12, when the lockdowns first started to appear. At the height of this crisis, shipment volumes were down as much as 36%. Simultaneously, freight delays from China to the US have risen spectacularly, hitting 35% at the end of April.

FourKites' 14-day average shipment volume for loads traveling from China to the US was down 20% as of April 29 compared to March 12, when the lockdowns first started to appear.

Container liners blanked sails to the Shanghai port complex — partly because they wanted to preserve their already horrid schedule reliability numbers and partly due to fewer containers to move off the Chinese coast. Ultimately, fewer vessels calling the US West Coast meant the ports of LA and LB could work through their vessel queues quicker, which at its zenith stood at over 100.

The West Coast ports have also gotten more efficient in the last few months, as is reflected in the average berth times that have fallen 16% across the US West Coast in April, compared to January. While repercussions from the Chinese implosion haven't reached the US shores yet (due to the buffer afforded by having vessel queues), it eventually will in a couple of months if the Chinese situation continues to be concerning. And with shippers moving more volumes to the intermodal segment at the expense of the trucking spot market, its loosening can be painful over the next few months.

The problem with demand aside, the trucking segment also suffers from an increase in capacity. While the fresh entry of trucking capacity into the market is plateauing, the increasing capacity is a byproduct of a system that's improving its efficiency. Port terminals, transshipment yards, and warehouses continue to improve their throughput, which reduces truck idling time outside their doors, essentially enabling truckers to spend more hours driving. These 'extra hours' equal additional capacity, added at no actual increase in total trucks plying within the country.

While the fresh entry of trucking capacity into the market is plateauing, the increasing capacity is a byproduct of a system that's improving its efficiency.

But with market conditions tied to several macroeconomic factors, it is hard to predict the future with a reasonable level of accuracy. "Historically, we've never had all these supply chain issues simultaneously. There are the shutdowns in Asia, consumer demand uncertainty, and the bullwhip effect that's creating hiccups," pointed out Closser.

"A lot of this hinges on the Chinese situation — as long as they operate at a lower capacity, it's not just the finished goods that stalls, but also the raw materials needing to make their way to production facilities within the US. So the broader cooling effect within transport networks might not be just inflation- or consumer-based, but also because there may not be enough products to move within the country."

Meanwhile, things are not looking bleak for contracts at the moment, with DAT data showing contracts to have eclipsed spot rates for the first time since July '20. Spot rates continue to fall, taking down tender rejections as carriers improve their routing guide compliance. Closser contended that contracts will not be renegotiated immediately to reflect falling spot prices, as shippers are wary of the changing environment.

"Three years ago, if this exact scenario played out, every shipper would be going to rebid right now and lock in lower rates. While there's optimism that the rates will settle at a new normal to what it was a couple of years back, shippers are cautious, and we are likely to see bid cycles in the mid-summer if the situation continues to play out the same way," said Closser.

The Weekly Roundup

Global supply chain issues have initiated a chain reaction that might concern many manufacturing companies worldwide. The challenges within the supply chain have created material scarcities, especially within the electronics industry, which in turn has been a partial cause for inflation, leading to overall softer consumer spending. According to the Institute for Supply Management’s indices, manufacturing is beginning to slip slowly but surely towards contraction.

While the market has undoubtedly favored carriers lately, the question is if they are profiteering from current global affairs. Many SMBs are struggling to find container space, as American importers voice out on shipping companies breaking their contracts and the eventual skyrocketing container rates. According to Accountable.US, the five largest container shipping companies have collectively increased profits by $41 billion over last year's earnings. This has led US importers to ask for federal intervention.

While port lockdowns continue in China due to the Omicron variant, the expected breaking point hasn’t happened yet, even after six weeks. Maersk’s Soren Skou and Matson’s Matt Cox believe that it’s not going to. Both Skou and Cox have said that their ships are still sailing from China, fully loaded despite the shutdown in Shanghai due to companies reallocating shipments to other neighboring ports. However, both caution that the world isn’t sailing into smooth seas quite yet.

New carrier alliances might take to the open seas in the near future. The big three in ocean freight, 2M, Ocean Alliance, and THE Alliance, aren’t set to expire until the late ‘20s. However, it is increasingly likely that the current alliance agreements will be mutually terminated and new agreements formed, especially in the wake of supply chain disruptions over the past two years. For shippers, many of the same power players will still be in charge, just rallying under different banners.

…said who?

“I can’t say whether we will go back to a 100 ships queuing up to dock, but we really need to get the existing cargo out of the port and out of Southern California.”

- Gene Seroka, executive director of the Port of Los Angeles, while commenting on the need to process containers quickly to avoid a possible vessel pileup after Chinese restrictions ease

Want to talk with us? Have something you'd like us to cover? Drop your thoughts to vishnu@truckx.com

We are TruckX, the Internet of Things plug to logistics. Check us out at www.TruckX.com