What Awaits The Trucking Industry In 2023?

The last year was a rollercoaster of emotions for the trucking market that now hopes for rates to steady themselves after tanking consistently for several months.

A hearty welcome to the 68th edition of The Logistics Rundown, a weekly digest that aims to put some perspective on what’s brewing within the logistics industry. This is a space where we religiously dissect market trends, chat with industry thought leaders, highlight supply chain innovation, celebrate startups, and share news nuggets.

It's 2023, and nearly three years since the pandemic brought the world to its knees. While COVID-19 is no longer the popular rhetoric, supply chains continue to relive uncertainties they have wrestled with since March '20. Last year, businesses witnessed see-sawing freight rates and capacity demand as the market tipped from being a carrier market at the start of the year to one favoring shippers by the end of it.

Importers moved earlier than usual in '22 to stock up inventories for the year-end peak season, leading to a situation where the actual shipping peak never materialized. This was anticipated to an extent, considering the debacle of the year before, where retailers were caught off-guard with inventories stuck on vessels or dwelling for weeks at yards with no available trucking capacity to move them.

Dec '22 could be a vantage point for industry stakeholders to understand consumer sentiments and determine where the market would move thereon. Despite the alarm bells, consumer demand has continued to hold up. While numbers for December aren't yet out, consumer spending went up by 0.1% in November (after a 0.9% decline in October) — a trend that might have sustained over December. For the most part, higher inflation seems to have had little effect on consumer demand resiliency over '22.

Even with sustained strong consumer demand over '22, inventory levels have not dipped into the contractual territory. The inventory levels index that the Logistics Managers' Index (LMI) puts out has a reading of 57.3 for Dec '22 (being a diffusion index, a score above 50 would mean expansion, and a score below 50 would mean contraction). The reading is not far from where inventory levels stood in Dec '21, which came at 61.6.

This is interesting to note, as while these are comparable numbers, the underlying reasons are not. The inventories destined for the '21 peak season arrived much later in the early months of '22 (LMI's Feb '22 reading was 80.2), showing that a chunk of the inventories held in Dec '21 was unintentional. In Dec '22, this situation had largely alleviated, with a better portion of the inventories stocked right on time for the holiday season.

That said, inventory levels are still high and in the expansive territory — has been for over two years now. Naturally, this impacts warehousing availability, with capacity in contraction for the 29th consecutive month, recording 44.7 on LMI's warehousing capacity index. It's no wonder, then, that we hear of parking lots and abandoned malls being repurposed as micro-fulfillment centers to accommodate demand.

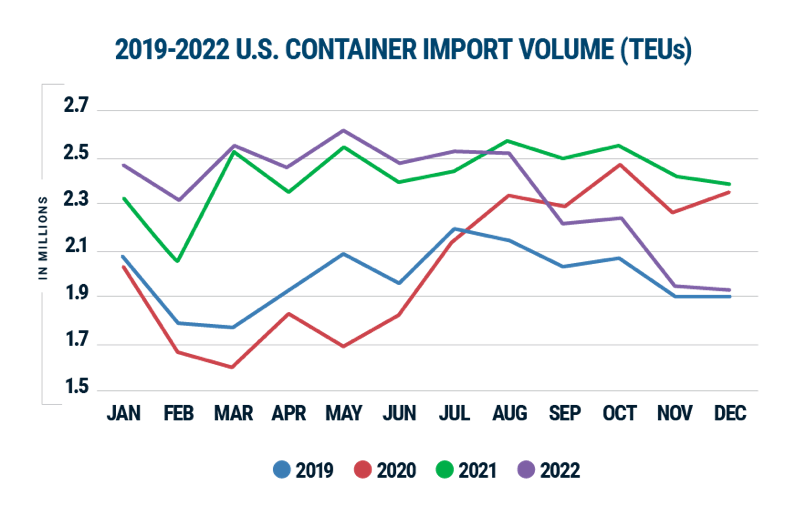

While warehousing is tight, the same can't be said of transport capacity or freight rates. Eastbound trans-pacific rates have largely returned to pre-pandemic levels, and so have overall US import volumes, as shown by Descartes. This is understandable, considering a tight warehousing market. Volumes can be expected to stay buoyant till the Chinese New Year, after which they could drop further.

Trucking activity depending on retail movement has seen a significant erosion of fortunes over the latter half of '22, as utilization and freight rates sunk. While demand for last-mile trucking remained healthy (considering strong e-commerce activity), the overall dry van market will face heavy headwinds over the first half of '23.

"I think we have some time before freight rates find a floor," said Matt Lawrence, CEO of Fox Logistics, an asset-based trucking firm. "This year is going to be very tough for carriers. However, I don't expect it to be as dramatic as it was in 2019 when we saw so many bankruptcies in the market."

True to that, the trucking market is yet to witness large-scale bankruptcies, as seen in the brutal winter of 2019. Trucking carriers remain buoyant on the back of profits made in the historically tight market preceding this. However, time's ticking, especially for the newer trucking entrants with high operational costs from running old assets they overpaid for during the '21 market craze.

"Record number of authorities were filed, old assets were bought at a premium, and many entered the market in completely unsustainable conditions," said Lawrence. "Last year, we sold trucks from 2015 that had clocked 500,000 miles for as much as we paid for them brand new. That's not a sustainable long-term strategy for a trucking business. Considering high fuel costs and increasing interest rates, falling freight prices will kill such carriers."

Carriers looking to sell a few assets to salvage their business might find a hard time selling, considering new equipment availability has increased in the market. Private fleets and large freight carriers are also selling off their old equipment for new ones, having run aging assets past their prime over the pandemic years.

"Demand for old equipment is generally driven by small fleets and owner-operators, who are on the verge of exiting the market. As freight demand falls and supply of old equipment rise in the market, we will see a crash in old equipment prices," said Lawrence.

Nonetheless, absolute volumes have continued to stay high, unlike '19, and there are reasons to expect a potential soft landing. That said, a lot depends on how retail and industrial activity holds up this year, with the latter driving a larger portion of the total volumes. While industrial activity has held up pretty well, cracks have started appearing (falling numbers in single-family housing) that could well expand over 2023.

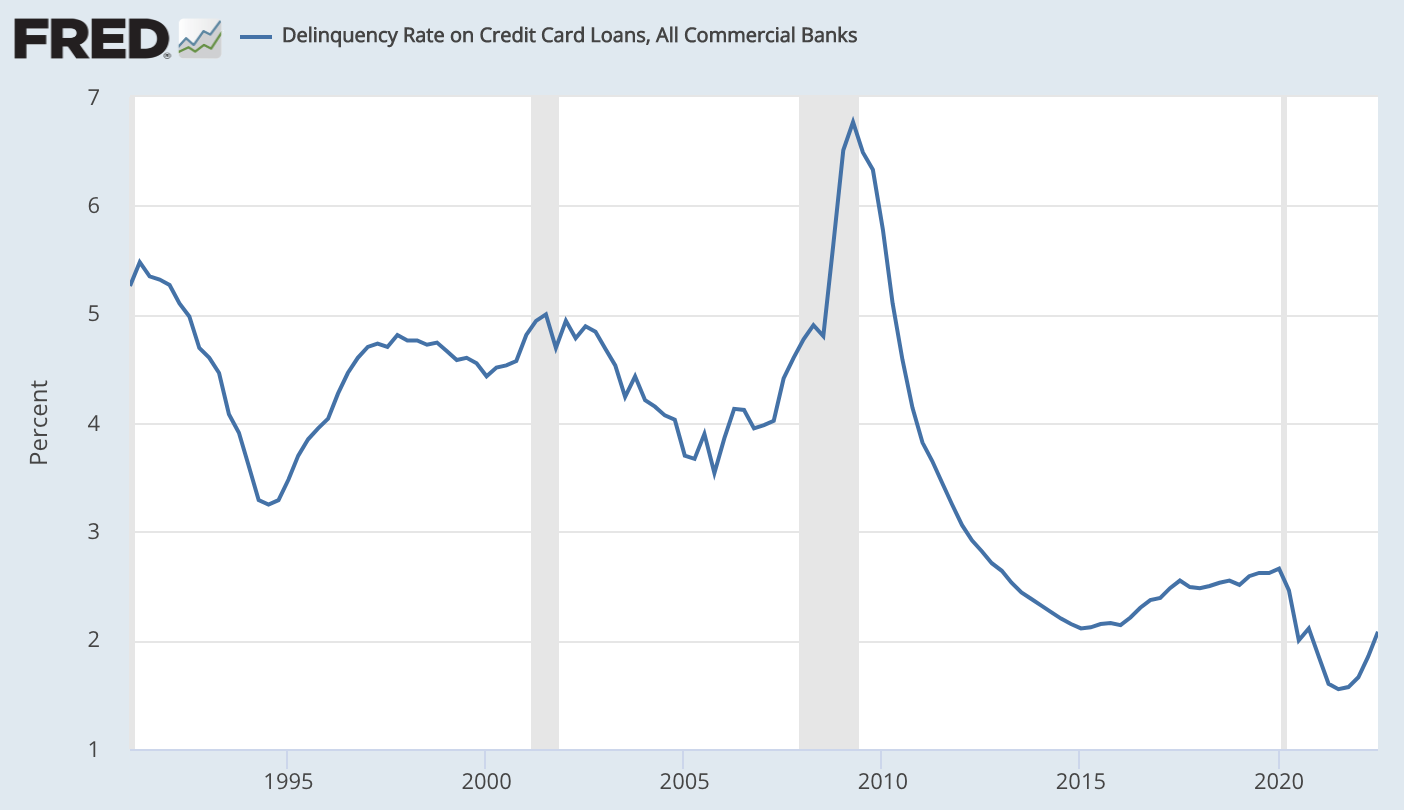

The health of retail consumers would largely not be of concern over the first half of this year. Delinquency rates on credit card loans (a good indicator of personal financial health) are considerably low, recorded at 2.08% in Q4 '22, compared to 2.66% in Q1 '20 (right before the pandemic). While delinquency rates are climbing from the historical low of 1.55 in Q3 ‘21, it is not a concern considering federal aid played a role in numbers dropping so low to begin with.

However, people are anticipated to spend more on services than goods this year. This will dent trucking volumes as money spent on services does not generate an equivalent need for freight moves as expending on goods does.

"The concern is if there's a longer recession," contended Lawrence. "But that's the worst-case scenario. The best case would be for us to see most new carriers exiting the market or joining larger fleets they left to start their own authority. The capacity will correct itself, and freight rates will find a floor."

The Weekly Roundup

Flexport is the latest entry in the growing list of freight tech companies to reduce its headcount. Originally valued at $8 billion, the rising star in freight tech announced this week in a company wide memo that it would have to cut global workforce by 20%. This is just four months after former Amazon boss Dave Clark joined Flexport founder Ryan Petersen as co-CEO.

The Port of Los Angeles was, by and large, the front lines for the US in the pandemic-induced global supply chain congestion. This time a year ago, a record 109 container ships were queued up, waiting to berth and unload. Now, the queues are gone, and the port is rather indicative of the global economy, slow and quiet.

US inflation is trending in the right direction, with a sixth consecutive month of decline as of December. The consumer-price index rose 6.5% in December, down from 7.1% in November and down considerably from the 9.1% peak in June. The decline is likely a combination of a post-holiday pullback in consumer spending and aggressive interest hikes from the US Federal Reserve.

As the general downturn in trade hits the world over, the only trade lane that seems to be doing well is the Asia-Mediterranean lane. Container spot rates have stabilized somewhere between $3,000 - $4,000, nearly double the going rate between Asia and Northern European ports. Other trade lanes continue to remain down, with sailings blanked or services suspended altogether.

…said who?

“After nearly three years of Covid-19’s impact on global trade and consumer demand, import patterns appear to be returning to what was normal prior to 2020.”

- Ben Hackett, the founder of Hackett Associates, commenting on overall US import volumes returning to pre-pandemic levels

Want to talk with us? Have something you'd like us to cover? Drop your thoughts to vishnu@truckx.com

We are TruckX, the Internet of Things plug to logistics. Check us out at www.TruckX.com