When US Freight Networks Play The Schrödinger’s Cat

Falling retail consumer demand is giving credence to a cooling freight market even as supply chains continue to sight bottlenecks in the horizon

A hearty welcome to the 45th edition of The Logistics Rundown, a weekly digest that aims to put some perspective on what’s brewing within the logistics industry. This is a space where we religiously dissect market trends, chat with industry thought leaders, highlight supply chain innovation, celebrate startups, and share news nuggets.

The last month has been an interesting inflection period in the trucking industry, as there are signs of a market slowdown after over a year of tight capacity and sky-high freight prices. As trucking capacity continues to flood the system, there are emerging signals of loosening capacity, as reflected in freight spot rates that have been on a downward trend since mid-January.

Falling tender rejections also lend credence to a cooling trucking market. The logic is that the fewer incoming loads trucking fleets reject, the more eager they are to haul available loads — mounting evidence of the desperation felt by truckers to match their capacity with freight.

However, there’s another side to this story that isn’t explored enough. Interestingly, contract freight prices have notched higher than spot prices for the first time in over a year, clouding the perspective of a falling market. To an extent, this explains the falling tender rejections too — as trucking fleets running on contracts would likely not reject them when they can make more money running contract loads than ply in the spot market.

That said, the fleets running contracts are usually the more established, larger firms — a lot fewer in number than the smaller fleets running in the spot market. Smaller fleets also do not have fuel surcharges, nor do they buy fuel in bulk like their larger counterparts, resulting in the spiking fuel prices directly hitting on their margins that are already marginal.

Fuel is about 25% of the operational costs in a regular market, and anything above would be detrimental to their cause (fuel contributes to roughly 35% of operational costs today). A lot of new trucking firm establishments in the last year have also meant they’ve purchased equipment at inflated rates, further pressuring their bottom line. With spot market prices sliding and new firms needing to pay off steep loans on their equipment, bankruptcy and receivership may soon be on the horizon.

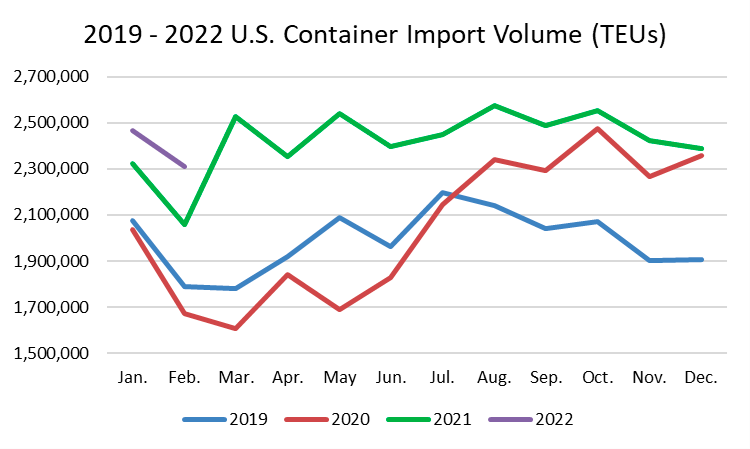

Nonetheless, all these forecasts hinge on falling consumer retail spending and, subsequently, retailer inventory stocking. In that context, port indicators can be confusing, as US container import volume continues to stay above year-on-year levels. Descartes data from the month of Feb ‘22 showed a 10% y-o-y growth, with the month seeing over 2.3 million TEUs processed at the ports.

The US logistics infrastructure is good enough to handle around 2.2-2.3 million import TEUs a month, and anything over that number would create bottlenecks. With February having 2-3 days fewer than a regular month, the recorded import TEUs made the month a stronger import month than Jan ‘22, which saw close to 2.5 million import TEUs.

If these high import volumes coincide with a drop in consumer demand, we would likely see an inventory glut. This would also mean that upstream transport needs will be stronger than downstream transport needs — which is reflected in the Logistics Managers’ Index (LMI) transportation utilization metrics, where late March numbers came out higher than in early March.

“The question here is if there is a sustained slowdown in people’s buying habits,” said Chris Jones, executive vice president of industry and services at Descartes. “The higher inflation rates and increase in interest rates will impact retail purchasing, but we aren’t sure to what extent.”

Inventory-to-sales ratio numbers have still some way to get back to pre-pandemic numbers, recording 1.13 on FRED data from Jan ‘22 — a number that had never gone below 1.35 in over a decade before the pandemic happened. The inventory-to-sales ratio is an important metric as it indicates the retailers’ ability to keep goods on physical or virtual shelves.

“For the better part of the year, I heard from frustrated retailers that supply dictated what they could sell and not the other way around. Usually, it’s retailers buying what they sell, but for a while, it’s been selling what they buy. So the tail has been wagging the dog,” said Jones. But things aren’t looking up — at least, not as much as it has been since the pandemic. As interest rates climb and warehousing prices remain spectacularly high, retailers will find it harder to hold onto their inventories in the coming months.

However, Jones believes that we are too early to make that call. “The lockdown in Shanghai and the drop in port productivity across the Shanghai region hit the US import volumes. When the region recovers from its new COVID wave, we can expect more volumes landing ashore, propping up transport prices.”

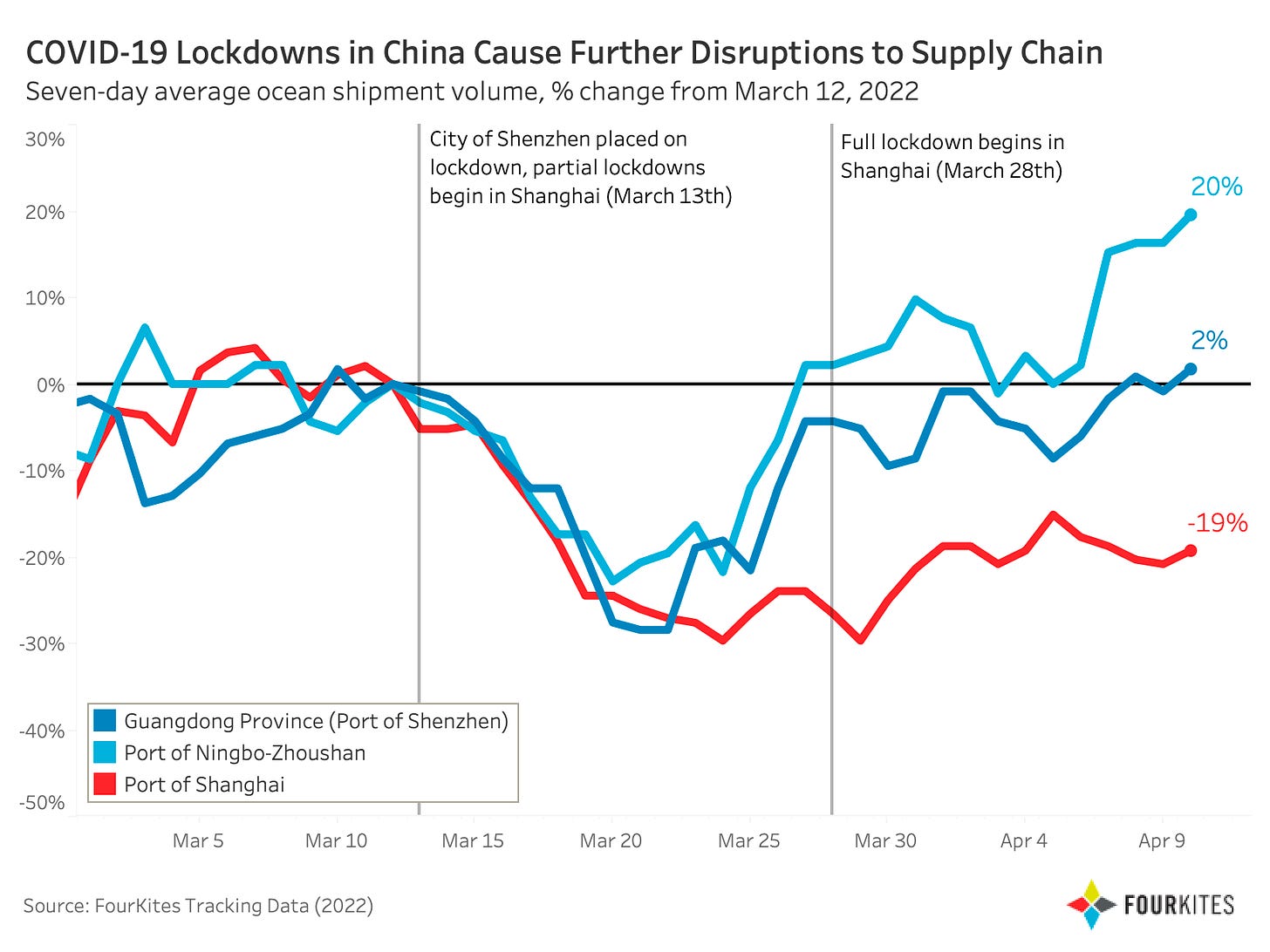

FourKites data shows that ocean volume in China is recovering from the significant decline it saw since March 12, when the lockdowns were announced across Shenzhen and Shanghai. The seven-day rolling average of ocean shipment volume from the Port of Shanghai is still 19% below its March 12 volume. That said, shippers have been trying to divert cargo to other neighboring ports, notably the port of Ningbo-Zhoushan, which has seen volumes rise by 20% since the lockdowns in Shanghai.

There are also the ILWU longshoremen contract negotiations coming up in May, which are expected to stall port operations as the union will try to play hardball. If the Chinese easing lockdowns coincide with the negotiations, it could lead to more vessels queuing up on the West Coast, hitting freight prices and subsequently creating added pressure on the inland transport network once negotiations end.

“In the meantime, if truckload prices do continue to fall lower, it will lead to thousands of bankruptcies of predominantly smaller and newer trucking fleets that aren’t ready for the rainy day,” said Jones. “This will consequently reduce available capacity and lead to a tighter market. Either way, these high prices seem to be here to stay, even if historically high freight prices do not hold forever.”

The Weekly Roundup

Conflicting reports are coming from Chinese ports that claim operations continue as normal despite COVID lockdowns. Despite increased pandemic protocols, port officials note there has been no noticeable increase in diversions from Shanghai to Ningbo-Zhousahn. However, media reports show as many as 350 vessels are waiting to berth as the lockdowns bite road transportation. “Shipping lines are very concerned about the significantly reduced volumes in Shanghai in the upcoming weeks. We strongly recommend alternative loading ports, such as Ningbo and Taicang, for urgent shipments,” warns freight forwarder Geodis.

Class 8 truck manufacturers have learned their lesson the hard way and continue to scale back orders to keep their backlogs manageable. Due mainly to the semiconductor shortage, most truck manufacturers are having a difficult time keeping up with production demands. To avoid cancelations and increasing backlogs, OEMs are forecasting productions on a month-to-month basis only, leaving to a market that has been “frozen in place.”

The industry-wide goal is to reach “net-zero” for carbon emissions, considering it is one of the most significant contributors of CO2 emissions. While this goal is challenging to attain, several startups have mushroomed in the space to tackle this specific problem. One such startup FleetZero is targetting the ocean freight industry, having designed an electric ship that could remove the need for CO2-producing fuel systems in exchange for rechargeable batteries.

Given the current market environment, the fashion industry could rethink its logistics strategies during its typical post fashion month and Oscars lull. The good news is that container prices from Shanghai to Los Angeles are down 20%, the lowest they’ve been since June of 2021. On the flip side, many fashion companies are pulling out of Russia (either temporarily or permanently) due to the sanctions, signaling other changes in fashion supply chain strategies.

…said who?

“It would be really great if the state and the county, the companies and the communities, could get into some kind of a discussion to solve this problem, because we’re under siege.”

- Anne Franke, a Pennsylvanian retiree, while voicing her opposition as part of a people protest to the surge in warehousing construction in the region, choking roads and adding pollution

Want to talk with us? Have something you'd like us to cover? Drop your thoughts to vishnu@truckx.com

We are TruckX, the Internet of Things plug to logistics. Check us out at www.TruckX.com